Accounts receivable aging report everything you need to know

dezembro 30, 2021Leovegas Casino Recension Sveriges Populäraste Mobil Casino

fevereiro 15, 2022Content

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year.

- Since this figure is on the credit side, this $300 is subtracted from the previous balance of $24,000 to get a new balance of $23,700.

- The same process occurs for the rest of the entries in the ledger and their balances.

- Therefore, their accounting cycle revolves around reporting requirement dates.

- GJ5 indicates that the entry can be found on page 5 of the general journal.

- In accounting software, the transactions will instead typically be recorded in subledgers or modules.

The accounts payable ledger is not a separate set of books from those used for general accounting purposes. Rather, it is simply a convenient way to group all creditors’ accounts together in one place. The checkmark indicates that an individual posting has been made to the accounts payable ledger.

ways finance pros can recession-proof SaaS companies

The Subtotal row gives you details about the subtotals for your debits and credits. Because this is a Checking (asset) account, deduct the credits from your debits to get the account’s total balance. To keep your records accurate, you should post to the general ledger as you make transactions. At the end of each period (e.g., month), transfer journal entries into your ledger. When posting entries to the ledger, move each journal entry into an individual account.

- However, the trial balance does not serve as proof that the other records are free of errors.

- When a business has only a few creditors, it is possible to maintain a separate Accounts Payable account for each creditor.

- It is a good idea to familiarize yourself with the type of information companies report each year.

- At the end of the accounting period, after the postings have been completed, a list is made of all the individual subsidiary accounts.

- Please do not copy, reproduce, modify, distribute or disburse without express consent from Sage.

- Keeping your ledger up-to-date can help you avoid penalties and ensure that your records give you an accurate picture of your business’s finances.

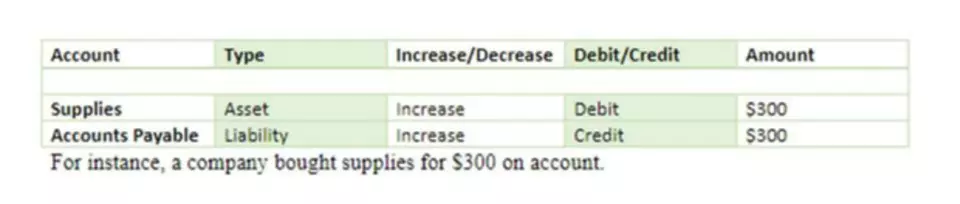

If you debit an account in a journal entry, you will debit the same account in posting. If you credit an account in a journal entry, you will credit the same account in posting. After transactions are journalized, they can be posted either to a T-account or a general ledger. Remember – a ledger is a listing of all transactions in a single account, allowing you to know the balance of each account.

Definition of Posting Accounting

Notice that for this entry, the rules for recording journal entries have been followed. Consider the following example where a company receives a ,000 payment from a client for its services. (whitejasmine.com) The accountant would then increase the asset column by $1,000 and subtract $1,000 from accounts receivable. The equation remains in balance, as the equivalent increase and decrease affect one side—the asset side—of the accounting equation. At the end of the accounting period, these items would be consolidated and posted into one line item in the general ledger. Closing Entries recorded in the Journal for preparing the Trading and Profit and Loss Account, i.e., transferring revenue and expenditure accounts to these two accounts.

What is the posting process?

Answer and Explanation: The posting process is the process of transferring the accounts involved in journal entries into the specific ledgers.

Posting Keys in SAP FI are used to determine Account types (A, D, K, M, and S) and also the type of posting. As of October 1, 2017, Starbucks had a total of $1,288,500,000 in stored value card liability. This similarity extends to other retailers, from clothing stores to sporting goods to hardware. No matter the size of a company and no matter the product a company sells, the fundamental accounting entries remain the same.

Table of Contents

The cost of sales is subtracted from that sum to yield the gross profit for that reporting period. At the end of the year, financial statements are generally prepared, which are often required by regulation. Public entities are required to submit financial statements by certain dates. All public companies that do business in the U.S. are required to file registration statements, periodic reports, and other forms to the U.S.

What is an example of posting in accounting?

For example, if the purchase account has debit entries of $10000, $5000 and $3000 while credit entires as $1000 and $2000 then the sum will be $18000 and $3000 respectively. As a result, the final balance will be debit minus credit on the last date i.e $15000.

The schedule of accounts receivable for the customers in our example is shown next. When a business has only a few creditors, it is possible to maintain a separate Accounts Payable account for each creditor. The general ledger should include the date, description and balance or total amount for each account. For example, if the purchase account has debit entries of $10000, $5000 and $3000 while credit entires as $1000 and $2000 then the sum will be $18000 and $3000 respectively. As a result, the final balance will be debit minus credit on the last date i.e $15000.

How the Accounting Cycle Works

A chart of accounts lists all of the accounts in the general ledger. For asset accounts, which include cash, accounts receivable, inventory, PP&E, and others, the left side of the T Account (debit side) is always an increase to the account. The right side (credit side) is conversely, a decrease to the asset account. https://www.bookstime.com/articles/music-industry-accounting For liabilities and equity accounts, however, debits always signify a decrease to the account, while credits always signify an increase to the account. Some general ledger accounts are summary records called control accounts. The details to support each control account are maintained outside in a subsidiary ledger.

The accounts, called T-accounts, organize your debits and credits for each account. There is a T-account for each category in your accounting journal. Gift cards have become an important topic for managers of any company.

Connect With a Financial Advisor

An accounting ledger is an account or record used to store bookkeeping entries for balance-sheet and income-statement transactions. Accounting ledger journal entries can include accounts like cash, accounts receivable, investments, inventory, accounts payable, accrued expenses, and customer deposits. Accounting ledgers are maintained for all types of balance sheet and income statement transactions. Balance sheet ledgers include asset ledgers such as cash or accounts receivable. Income statement ledgers include ledgers such as revenue and expenses. The double-entry bookkeeping requires the balance sheet to ensure that the sum of its debit side is equal to the credit side total.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Harold Averkamp (CPA, MBA) has worked as a university posting in accounting accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com.