Accounts Payable Ledger Definition, Format, & Posting

fevereiro 2, 2022Content

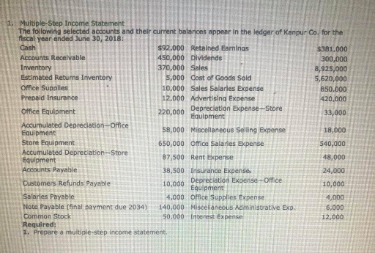

When you make a purchase and don’t immediately pay , your accounts payable increases. The supplier or vendor invoices you, and you pay them back at a later date. In most cases, the accounts payable aging report should be run and reviewed on a monthly basis. Doing so allows you to see whether you are making payments appropriately or relying too heavily on credit. In each applicable aging column, the total amount of the balance of the invoices due is shown for each applicable days outstanding range.

These six AP improvements improve cash flow, ensure that bills are paid at the right time, speed problem resolution and increase efficiency and accuracy. Dashboards provide the AP group with an at-a-glance view of the information they need to monitor the company’s spending and keep the AP process running smoothly. Dashboards can also be used to track overall AP department efficiency metrics. Leading accounting solutions allow dashboards to be customized for different roles and user requirements.

Voucher activity report

The accounts payable aging schedule gives you a good indication of the amount of cash needed to cover your expenses during the same time period. Using the example schedule above, Fortmann’s Hawkeye Haven will need to generate at least $7,750 in income to cover the current month’s purchases on account. Accounting software, you’ll be able to generate accounts receivable aging reports.

This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. No assurance is given that the information how to prepare accounts payable aging report is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit Inc. does not have any responsibility for updating or revising any information presented herein.

Refine Your Company’s Accounts Receivable Collection Practices

It will also facilitate a real-time update of your current cash flow. It is also helpful when a company is short on cash and must choose which vendors to pay in the meantime. The report enables the company to quickly identify such vendors by simply looking at the most urgent invoices.

What is an aging report for accounts payable?

An accounts payable aging report is a record of payments a company owes to its vendors or suppliers. Using an AP aging report helps businesses manage their financial obligations more effectively. In particular, the report serves as a guide in identifying which invoices are past due.

Together, we provide innovative solutions that help F&A teams achieve shorter close cycles and better controls, enabling them to drive better decision-making across the company. Automated reminders are one of the simplest tools for ensuring that bills are paid at the right time. As a business grows, the sheer number of bills can become overwhelming — and extremely difficult to track manually. As a result, payment dates may be missed, damaging vendor relationships and potentially triggering fees. (Diazepam online) With leading AP systems, you can set up customizable reminders that automatically prompt AP staff before bills are due, helping make sure that payments are made on time.

Benefits of using AP aging summary for small businesses

Older accounts receivable represent a credit risk to your company because, if customers haven’t paid, one possible reason is that they are unable to. Compare your overall accounts receivable aging against industry standards to determine if the amount of risk you’re taking on is appropriate for your industry. One of the main uses of an accounts receivable aging report is to identify customers behind on payments.

- BlackLine is a high-growth, SaaS business that is transforming and modernizing the way finance and accounting departments operate.

- It’s a popular way to operate, but it’s also a surefire way to run into cash flow problems if an unexpected bill comes due.

- They typically go to pay vendors and suppliers weekly, monthly, quarterly or annually.

- For example, say you paid off the $100 invoice that’s 61 – 90 days past due for Vendor 3.

- The first column could serve as a “current” invoice date range, meaning the invoice is not past due.

How do I create an AP aging report in Quickbooks?

- Go to the Reports menu.

- Choose Vendors & Payables, then Unpaid Bills Detail.

- Click Customize Report.

- Select Display.

- Modify the date.

- Click OK.